Gold delivered 13% returns during 2024’s market volatility – outperforming many traditional assets when inflation and geopolitical tensions challenged global markets. For investors seeking portfolio diversification beyond stocks and bonds, understanding gold investment approaches has become essential.

The precious metal generated positive returns in 7 of the last 10 recessionary periods since 1970, demonstrating effectiveness as both an inflation hedge and portfolio diversifier.

Key Takeaways

- Gold allocation of 5-15% optimizes portfolio risk-adjusted returns

- Physical ownership eliminates counterparty risk but requires storage planning

- Dollar-cost averaging reduces timing risks across market cycles

- Real interest rates below 2% favor gold performance

- Tax treatment at 28% collectibles rate affects net returns

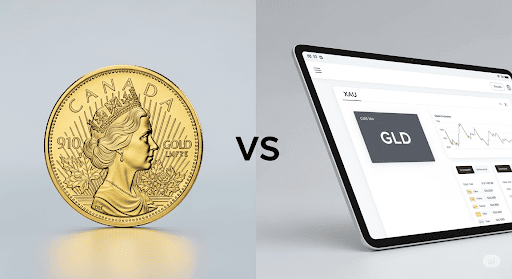

Physical Gold vs Paper Gold Investment Options

The choice between direct ownership and ETF exposure shapes your investment outcomes and risk profile. Each approach offers distinct advantages for different portfolio objectives.

Physical gold ownership eliminates counterparty risk entirely. When you hold gold coins or bars, you own the actual asset rather than a promise to deliver. During the 2008 financial crisis, several gold certificate programs failed to deliver physical metal when investors needed it most. Those holding actual gold faced no such constraints.

This direct ownership proved valuable during currency crises in Argentina (2001) and Turkey (2018), where physical gold holders maintained purchasing power against devaluing paper assets. The security comes with trade-offs – professional vault storage runs 0.5-1.0% annually and transaction spreads on physical purchases range from 3-8% over spot price.

Paper gold through ETFs like SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) offers superior liquidity for portfolio rebalancing. These instruments trade during market hours with spreads under 0.1%, making them ideal for tactical adjustments. Tax treatment differs – physical gold faces the 28% collectibles rate on gains whereas ETF shares qualify for capital gains treatment.

| Investment Vehicle | Liquidity | Annual Cost | Transaction Cost | Optimal Use Case |

|---|---|---|---|---|

| Physical Gold | Medium | 0.5-1.0% | 3-8% spread | Long-term core holdings |

| Gold ETFs | High | 0.25-0.4% | <0.1% spread | Active management |

| Gold Mining Stocks | High | Expense ratios vary | Standard equity commissions | Growth exposure |

The recommended hybrid approach allocates 60-70% to physical holdings for core positions with 30-40% in ETFs for tactical adjustments. This structure provides security benefits of direct ownership and maintains portfolio management flexibility. For portfolios under $100,000, consider increasing the ETF allocation to 50% to optimize transaction costs.

Age-Based Allocation Models

Gold investment approach should match your risk tolerance, time horizon, and portfolio objectives. These models provide specific guidance based on investor demographics and financial goals.

Conservative Model (Ages 55+)

Target Allocation: 5-8% of total portfolio

Structure: 80% physical holdings, 20% ETFs

Rebalancing: Quarterly assessment with annual adjustments

Focus: Capital preservation and purchasing power maintenance

Conservative investors prioritize wealth preservation over growth, making gold’s store of wealth characteristics particularly appealing. The 5-8% allocation provides meaningful diversification benefits without overwhelming fixed-income focused portfolios.

During the 2022 inflation surge, portfolios with 7% gold allocation maintained purchasing power better than traditional 60/40 stock-bond portfolios that declined 12-15%. Physical gold dominance (80%) in this model reflects long-term holding periods and reduced need for frequent rebalancing.

Recommended products include 1-ounce American Gold Eagles or Canadian Gold Maples, which offer strong liquidity and recognition. Storage should emphasize security over accessibility – professional depositories or bank safety deposit boxes work well for this model.

Balanced Growth Model (Ages 35-55)

Target Allocation: 7-12% of total portfolio

Structure: 70% physical holdings, 30% ETFs

Dynamic Triggers: Increase when VIX exceeds 25 for sustained periods; reduce during strong economic growth (GDP >3% annually)

This model accommodates moderate risk tolerance with longer investment horizons. The wider allocation range (7-12%) allows tactical adjustments based on economic conditions. During market stress periods – defined as VIX above 25 for more than 30 consecutive days – increasing gold allocation to the upper range (10-12%) has delivered superior risk-adjusted returns.

Economic cycle awareness drives allocation decisions. During robust growth phases with GDP expansion above 3%, gold tends to underperform growth assets, suggesting allocation toward the lower range. During economic uncertainty or recession fears, increasing gold exposure to 10-12% has improved portfolio stability.

Aggressive Opportunity Model (Under 35)

Target Allocation: 10-15% of total portfolio

Tactical Positioning: Based on real interest rates and inflation expectations

Risk Management: Higher volatility tolerance leverages gold’s cyclical characteristics

Younger investors can exploit gold’s volatility benefits from longer time horizons. The higher allocation (10-15%) reflects aggressive positioning during optimal economic conditions maintaining diversification benefits.

Real interest rates serve as the primary tactical signal – when 10-year Treasury yields minus CPI fall below zero, gold has delivered 15-25% annual returns. This model emphasizes opportunity recognition. When gold/silver ratios exceed 80:1 (historical average: 50:1), tactical allocation increases target gold holdings by 2-3%.

Building Gold Positions and Dollar-Cost Averaging

Building gold positions requires managing both market timing risks and operational complexities. This phased approach reduces transaction costs during position establishment.

Phase 1 Foundation Building (Months 1-3)

Month 1 Tasks:

- Complete risk assessment using the allocation models above

- Determine target allocation based on age, risk tolerance, and portfolio composition

- Research physical gold dealers with Better Business Bureau ratings above A- and transparent pricing

- Establish initial 25% of target allocation to begin position building

Dealer Selection Standards:

- Minimum 10-year operating history with customer reviews

- Published buy/sell spreads with minimal markup over spot prices

- Guaranteed repurchase programs with competitive spreads

- Insurance coverage and secure delivery methods

Dollar-Cost Averaging Execution

Standard Purchase Schedule: Monthly acquisitions over 6-month period, investing equal dollar amounts regardless of price fluctuations. This approach eliminates timing risks during position building. A $6,000 target allocation becomes $1,000 monthly purchases for six months.

Accelerated Purchase Triggers: When gold prices decline more than 15% from recent 6-month highs, consider accelerating the purchase schedule. Historical analysis shows significant gold price drops reverse within 3-6 months, creating opportunities for improved returns.

Purchase Method: Equal dollar amounts work better than equal ounce quantities. During price volatility, this approach naturally buys more ounces when prices decline and fewer when prices rise – the core principle of effective dollar-cost averaging.

Storage Solutions Analysis

Home Storage (Holdings <$50,000): Suitable for smaller allocations with proper security measures including fireproof safe, home security system, and adequate insurance coverage. Consider geographic risk – areas prone to natural disasters may require off-site storage solutions.

Bank Safety Deposit Boxes: Medium security option with limited accessibility. Annual costs range from $50-200 depending on size and location. FDIC insurance doesn’t cover safety deposit box contents – separate insurance required for full protection.

Professional Depositories: Optimal for larger holdings requiring segregated storage. Leading facilities include Delaware Depository, Brinks, and International Depository Services. Costs range from 0.5-1.0% annually with insurance coverage. Segregated storage ensures your bars/coins remain separately identified.

Transaction Cost Management

Minimize dealer premiums through bulk purchasing. Orders above $10,000 qualify for reduced spreads – 1-2% lower than smaller transactions. Time purchases during market volatility periods when spreads compress from increased dealer inventory turnover.

Account for total cost of ownership in return calculations. Include storage fees, insurance costs, and transaction spreads when evaluating performance. These costs range from 1.5-2.5% annually for professional programs, impacting long-term returns.

Market Timing and Economic Indicators

Understanding key economic indicators improves tactical positioning and timing decisions within established allocation ranges. These metrics offer objective signals for adjusting gold exposure.

Primary Indicators (Weekly Monitoring)

Real Interest Rate Calculations:

Formula: 10-Year Treasury Yield minus Current CPI Rate

Signal interpretation: Negative real rates correlate with strong gold performance

Historical relationship: -0.65 correlation between real rates and gold prices over 15 years

When real interest rates turn negative, gold becomes more attractive relative to yield-bearing alternatives. The 2020-2022 period demonstrated this relationship – sustained negative real rates coincided with gold’s rise from $1,500 to over $2,000 per ounce.

Dollar Strength Index (DXY) Analysis:

- Bullish gold signal: DXY declining below 95

- Bearish indication: DXY rising above 105

- Current implication: Dollar strength pressures gold prices through reduced international purchasing power

Central Bank Policy Coordination: Monitor Federal Reserve communications for policy shifts affecting dollar strength and interest rates. European Central Bank and Bank of Japan policies impact global liquidity conditions influencing gold demand. Emerging market central bank purchases – from China, Russia, and India – provide underlying demand support.

Secondary Indicators (Monthly Assessment)

Market Sentiment Measurements: VIX levels above 25 correlate with increased gold allocation benefits. During sustained volatility periods, gold’s negative correlation with equity markets improves portfolio stability. Current VIX readings provide insight into market stress levels and potential gold demand.

Gold/Silver Ratio Analysis:

- Historical average: 50:1 ratio

- Tactical signals: Ratios above 80:1 suggest silver outperformance potential; below 40:1 indicates gold strength

- Trading application: Extreme ratios revert toward historical means within 12-18 months

Learn More: Investing in Gold vs. Silver Coins

Supply/Demand Analysis: Annual mine production runs about 3,200 tonnes globally, with declining ore grades pressuring future supply growth. Industrial demand from electronics and renewable energy sectors continues expanding. ETF inflow/outflow data provides insight into institutional investor sentiment.

Tactical Application

Buy Signals (Increase allocation within target ranges):

- Real interest rates negative for 3+ months

- DXY declining below 95 with trend confirmation

- VIX sustained above 25 with equity market stress

- Central bank net purchases exceeding quarterly averages

Hold Signals (Maintain baseline allocation):

- Real interest rates positive but below 2%

- Economic growth moderate (GDP 2-3% range)

- Currency markets stable without major trend changes

Reduce Signals (Lower allocation toward range minimums):

- Real interest rates above 3% with rising trend

- Strong economic growth (GDP >4%) with low inflation

- Dollar strength index above 105 with momentum

These indicators work best in combination. Negative real rates combined with dollar weakness and elevated volatility provides stronger buy signals than any single factor alone.

Rebalancing and Performance Monitoring

Disciplined rebalancing maintains target allocations during gold’s cyclical behavior. These methods ensure portfolio management without emotional decision-making.

Trigger-Based Rebalancing

Level 1 Triggers (Monthly Monitoring): When gold allocation drifts more than 2% above or below target ranges, initiate rebalancing through new portfolio contributions. This approach minimizes tax consequences and maintains target exposure. If target allocation is 8% but current weight reaches 10.5%, direct new contributions toward other assets until balance restores.

Level 2 Triggers (Immediate Action Required): Gold allocation exceeding 5% deviation from targets requires active buying or selling to restore balance. Tax-advantaged accounts should be prioritized for rebalancing transactions to minimize tax impacts. This threshold occurs during major gold price movements or portfolio value changes.

Performance Tracking Methods

Essential Metrics Dashboard:

- Absolute returns: Compare gold allocation performance against spot gold returns

- Risk-adjusted performance: Calculate Sharpe ratios including storage and transaction costs

- Correlation benefits: Measure portfolio volatility reduction from gold inclusion

- Maximum drawdown analysis: Track worst-case scenario impacts during stress periods

Quarterly Review Template:

Gold Allocation Assessment - Q1 2025

Current Allocation: [X]% (Target: [X]%)

Quarter Performance: [X]%

YTD Performance: [X]%

vs S&P 500 Correlation: [X]

Rebalancing Action Required: [Yes/No]

Storage/Transaction Costs: $[X]

Annual Evaluation

Performance Assessment: Review allocation targets based on performance during various market cycles. Assess whether your approach provided expected diversification benefits during stress periods. Document portfolio behavior during inflation cycles, recession fears, and market volatility to refine future approaches.

Cost-Benefit Analysis: Calculate total cost of ownership including storage, insurance, and transaction expenses. Compare against alternative precious metals exposure through ETFs or mining stocks. Evaluate whether physical ownership premiums were justified by security and counterparty risk elimination.

Documentation: Record lessons learned from market cycles and economic events. Update trigger points based on transaction costs and tax consequences from rebalancing activities. Adjust allocation ranges if risk tolerance or investment objectives change with age or circumstances.

Frequently Asked Questions

How much gold should I own in my portfolio?

Most investors benefit from 5-15% allocation depending on age and risk tolerance. Conservative investors (55+) should target 5-8%, balanced investors (35-55) work well with 7-12%, and aggressive investors (under 35) can handle 10-15%. Start with the lower range and increase based on market conditions.

Should I buy gold bars or coins?

Bars offer lower premiums (2-4% over spot) but bullion coins provide better liquidity and recognition. For beginners, American Gold Eagles or Canadian Gold Maples are ideal despite higher premiums (4-7%). Experienced investors building larger positions prefer bars for cost efficiency.

Where should I store my gold?

Home storage works for smaller holdings (<$50,000) with proper security measures. Bank safety deposit boxes offer medium security but limited access. Professional depositories provide optimal security for larger holdings with segregated storage options. Factor storage costs (0.5-1.0% annually) into your returns.

How are gold investments taxed?

Physical gold is taxed as a collectible with capital gains rates up to 28%, higher than stocks or bonds. Gold ETFs qualify for standard capital gains treatment. Hold gold in tax-advantaged accounts when possible to defer or eliminate tax impacts.

When should I sell my gold?

Gold works best as a long-term holding (3+ years minimum). Consider selling when allocation exceeds targets due to price appreciation, during sustained economic growth with rising real interest rates, or when you need portfolio rebalancing. Avoid emotional selling during short-term volatility.

Getting Started with Physical Gold Investing

Gold investment requires balancing disciplined approaches with tactical flexibility. Start with a small position (2-3% of portfolio) to gain experience before building to target allocations.

Current market conditions with elevated inflation risks and geopolitical tensions favor gold allocation within the recommended ranges. Focus on building positions methodically rather than trying to time optimal entry points.