Gold hit new highs in the first quarter, and I’ve fielded hundreds of questions about which coins make sense for investment. After covering precious metals markets for 15 years, I’ve seen every hype cycle.

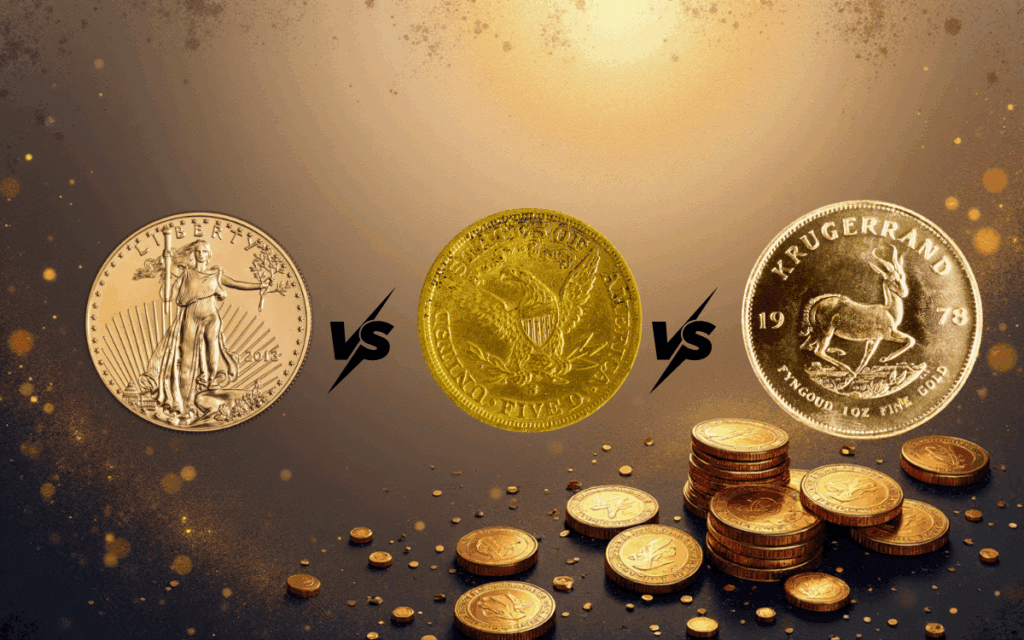

Your choice between American Eagles, Canadian Maples, and Krugerrands determines your premiums, liquidity, and returns.

Physical Gold Coins Make Investment Sense

Gold coins investment serves a different function than gold ETFs or mining stocks. When markets panic and paper assets lose value, physical gold maintains its purchasing power. I witnessed this during 2008, when gold coin owners slept soundly as stock portfolios collapsed.

Key Advantages

Complete ownership without counterparty risk. ETFs can fail, mining companies can go bankrupt, and gold certificates can become worthless. Physical coins eliminate these risks.

Better liquidity than bars or jewelry. Sell a gold bar and you’ll wait days for authentication. Government-minted coins trade instantly at any coin dealer globally.

Portfolio insurance that works. Gold moved opposite to stocks during every major crisis of the past 50 years. The 1970s inflation surge, the 2008 financial crash, and the 2020 pandemic all drove investors to physical gold.

The Three Coins That Dominate Investment Markets

After analyzing premium data and liquidity patterns from hundreds of dealers, three coins clearly control the investment-grade market.

American Gold Eagle

The most liquid gold coin in North America. American Gold Eagles trade at 3-6% over spot gold prices and enjoy instant recognition at every dealer.

Investment advantages:

- Accepted without testing or verification delays

- Available in four sizes (1 oz, 1/2 oz, 1/4 oz, 1/10 oz)

- U.S. government guarantee of weight and purity

- Strong resale market during market stress

Eagles command higher premiums than other coins, but this premium returns when you sell. During market uncertainty, Gold Eagles often trade at the smallest discount to their original premium.

Canadian Gold Maple Leaf

At .9999 purity versus .9167 for Eagles, Maple Leafs appeal to investors wanting maximum gold content per dollar. They trade at 2-4% premiums, making them cost-efficient choices.

Investment benefits:

- Lower premiums than American Eagles

- Highest purity among major government coins

- Advanced anti-counterfeiting features including radial lines

- Strong international recognition, notably in Europe

The main drawback? Gold Maples can develop milk spots (white discoloration) over time, though this doesn’t affect their gold content or value.

South African Gold Krugerrand

The original modern bullion coin, introduced in 1967, remains popular among cost-conscious investors. Krugerrands trade closest to spot gold prices at 2-3% premiums.

Investment characteristics:

- Lowest premiums among major government coins

- Durability from copper alloy (.9167 gold, .0833 copper)

- Wide dealer acceptance from 50+ year track record

- Available in fractional sizes for smaller budgets

Some newer dealers show less enthusiasm for Krugerrands because of historical political issues, but established precious metals dealers trade them readily.

Buying Strategies for Gold Coins Investment

Premium Analysis

Track premium spreads weekly. They fluctuate based on supply shortages, demand spikes, and market volatility. Paying 8%+ premiums signals you’re buying at the wrong time or from the wrong dealer.

Volume and Storage

Volume purchasing saves money. Most dealers offer bulk discounts starting at 10-20 coins, with meaningful savings at 50+ pieces. Calculate total cost including shipping and insurance before committing.

Storage planning prevents expensive mistakes. Bank safe deposit boxes cost $50-150 yearly. Home safes require insurance adjustments and security upgrades. Plan storage before taking delivery.

Dealer Selection

Dealer verification protects your investment. Check Better Business Bureau ratings, industry memberships, and online reviews. The precious metals industry attracts both legitimate dealers and sophisticated scams.

Market timing matters less than consistency. Dollar-cost averaging over 6-12 months works better than trying to time gold’s volatile price swings.

Avoid These Costly Mistakes

Paying excessive premiums for marketing claims. TV commercials pushing ‘collector editions’ or ‘limited mintage’ coins target uninformed buyers. These products often carry 20-40% premiums with minimal extra value.

Confusing collectible value with investment value. Rare coins trade on numismatic demand, not gold content. Investment coins should trade on metal value.

Inadequate storage and insurance planning. Standard homeowner’s insurance covers $1,000-2,500 in precious metals maximum. Plan separate precious metals insurance or professional storage.

Failing to verify dealer legitimacy. Research dealer backgrounds, complaint histories, and financial stability. Purchasing precious metals can involve significant money and require trustworthy counterparties.

Emotional decision-making during price volatility. Gold prices swing 20%+ regularly. Successful gold coins investment requires treating purchases as long-term insurance, not short-term speculation.

Your First Gold Coin Purchase

Research current spot prices and premium ranges before buying. Start with recognized government coins – American Eagles, Canadian Maples, or Krugerrands provide liquidity and dealer acceptance. Document everything and arrange secure storage before delivery.

Smart gold coins investment means buying recognized coins at reasonable premiums from reputable dealers.